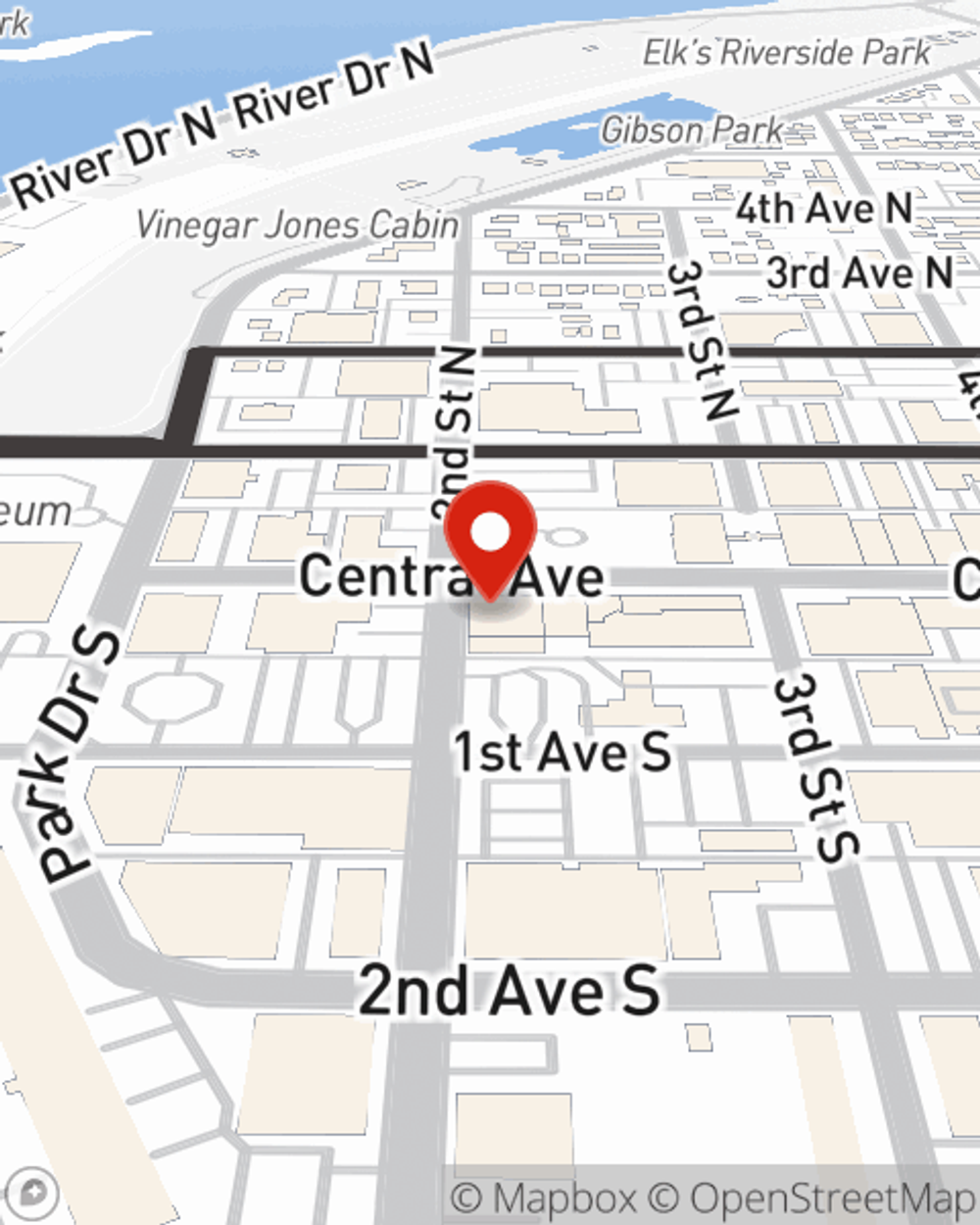

Life Insurance in and around Great Falls

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Great Falls, MT, friends and neighbors of all ages already have State Farm life insurance!

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Put Those Worries To Rest

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific time frame coverage for a specific number of years or another coverage option, State Farm agent Greg Franczyk can help you with a policy that works for you.

As a dependable provider of life insurance in Great Falls, MT, State Farm is committed to protect those you love most. Call State Farm agent Greg Franczyk today for a free quote on a life insurance policy.

Have More Questions About Life Insurance?

Call Greg at (406) 770-3040 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Greg Franczyk

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.